Black Friday and Cyber Monday are two of the most anticipated shopping events of the year. Traditionally, Black Friday falls on the day after Thanksgiving, marking the start of the holiday shopping season, while Cyber Monday, occurring the Monday after Thanksgiving, was introduced to encourage people to shop online.

Over the years, these shopping holidays have evolved, and so too has Amazon's approach. Their sales performance during these events is not just about the numbers - it's about understanding consumer behavior, staying ahead of market trends, and making strategic decisions that drive success.

Amazon begins advertising its deals weeks before the actual event, building anticipation among consumers. On the days of the sales, Amazon frequently updates its deals, ensuring there's always something new to entice customers. One key factor contributing to Amazon's success is its Prime membership. Prime members receive early access to deals, encouraging more sign-ups and increasing customer loyalty. This strategy has significantly boosted Amazon's sales performance, allowing the company to dominate the Black Friday and Cyber Monday shopping events.

Despite concerns about inflation, last Amazon's Black Friday event generated $9.12 billion from online sales, reaching a record high. This year, online spending during Black Friday hit $9.8 billion (7.5% above last year), and according to figures from Adobe, shoppers could spend up to $12 billion during Cyber Monday.

Some of the most successful categories on Amazon during these events are tech, home, beauty, and health.

OVERVIEW

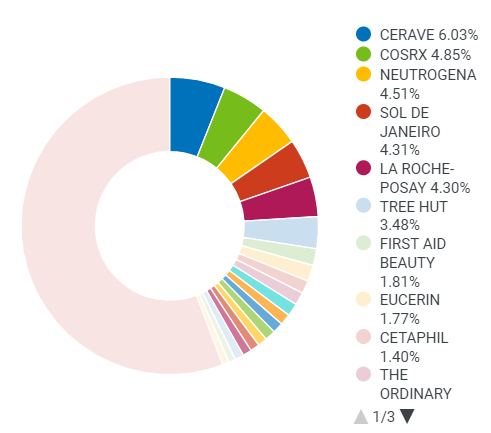

In the beauty category, brands such as CERAVE, CORSX, Neutrógena, and Sol de Janeiro dominate the market as shown below:

(Analytic Index)

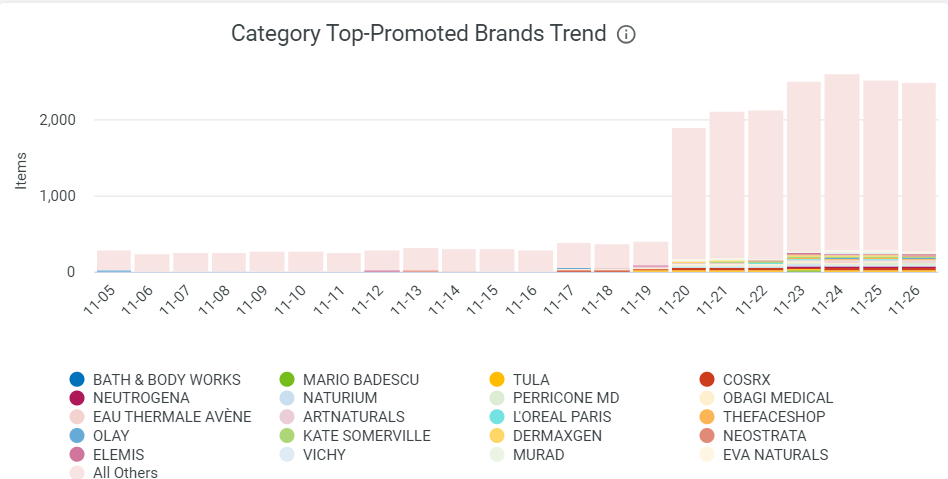

The market share didn’t change much during and before the black Friday and Cyber Monday events. We can also see that sales started to increase days before Black Friday, as most brands decided to launch deals and discounts previous to the event, which resulted in higher sales from the 20th of November:

PROMOTIONS

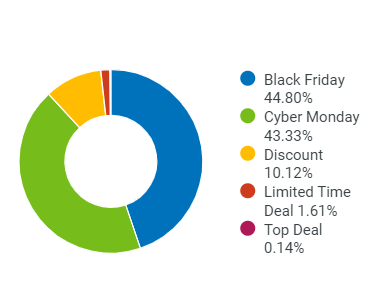

“Black Friday” was the most used promotional badge for this category (44.80%), followed by “Cyber Monday” (43.33%) and “Discount” (10.12%):

(Analytic Index)

ADVERTISING

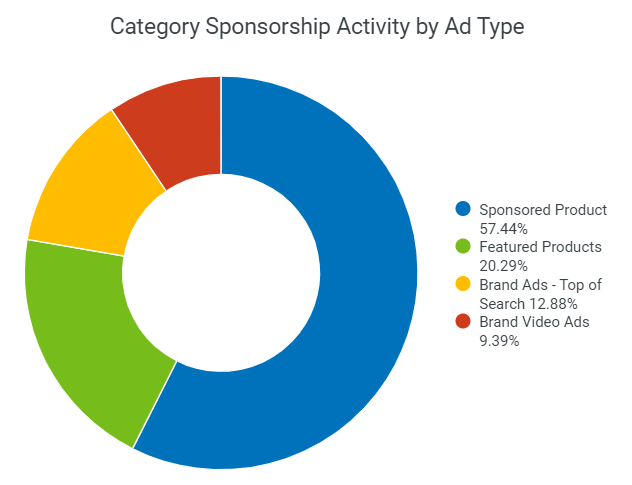

Beauty brands invested 54.44% of their advertising budget in Sponsored Product campaigns to show their discounts in the search results, followed by featured products with 20.29%, Sponsored Brands with 12.88%, and Brand Video Ads with 9.39%:

(Analytic Index)

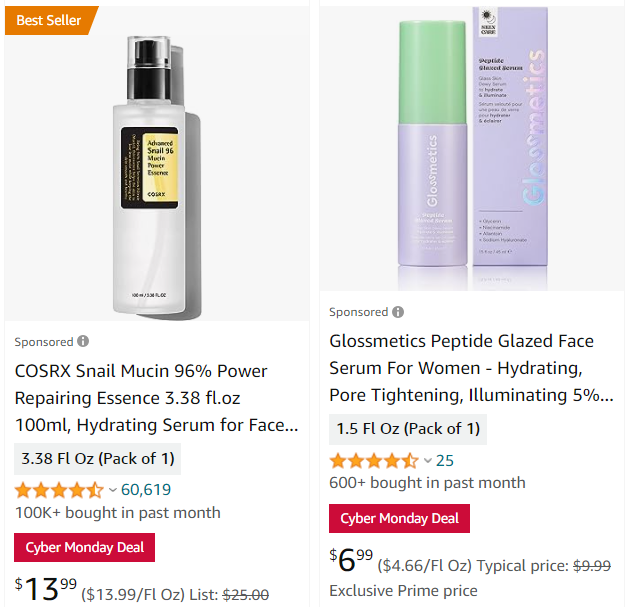

The following are some examples of these types of campaigns:

Sponsored Products Campaigns

Sponsored Brands Campaigns

Sponsored Video Ads

In the dynamic world of Amazon's Beauty category, navigating through its niche and competitive landscape requires strategic finesse. The importance of overcoming the challenges posed by expensive keyword bids and crafting a winning strategy involves maximizing exposure while optimizing costs to achieve sales goals for the upcoming event.

Understanding the market trends and consumer behavior in the Beauty and Personal Care category, BellaVix created a strategy to maximize sales and enhance brand visibility during BFCM. The approach encompassed a holistic campaign, integrating targeted advertising, optimized product listings, strategic pricing, and inventory planning.

SALES OVERVIEW

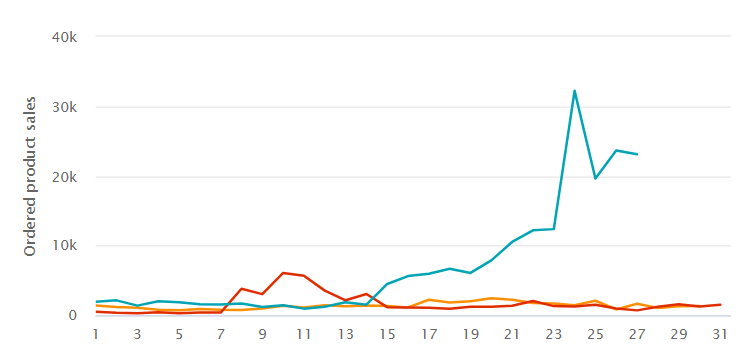

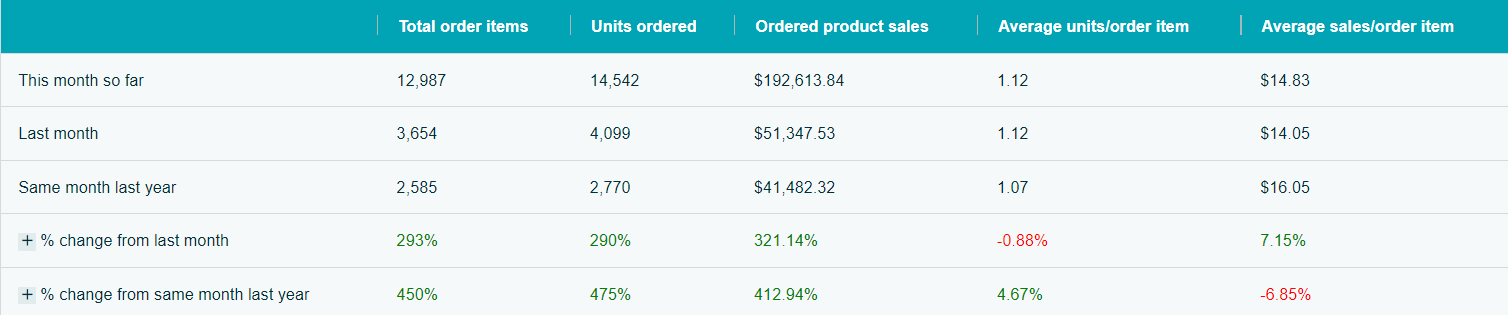

MTD (November 27th)

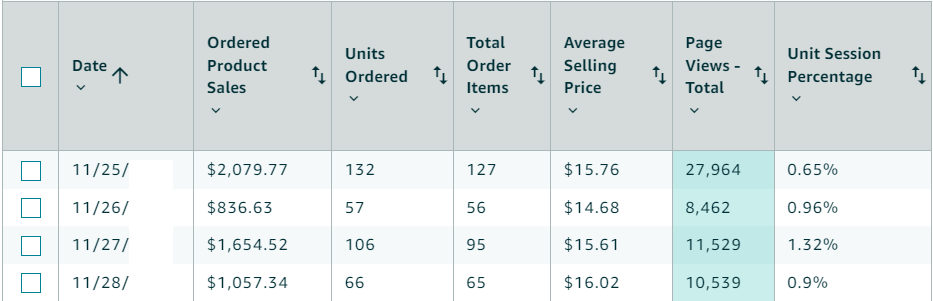

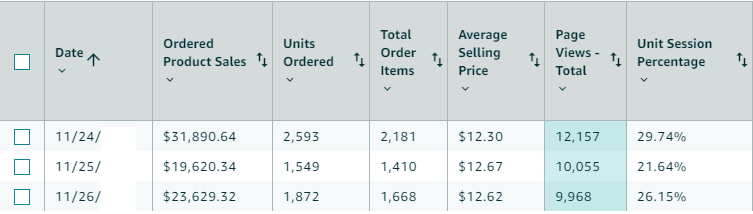

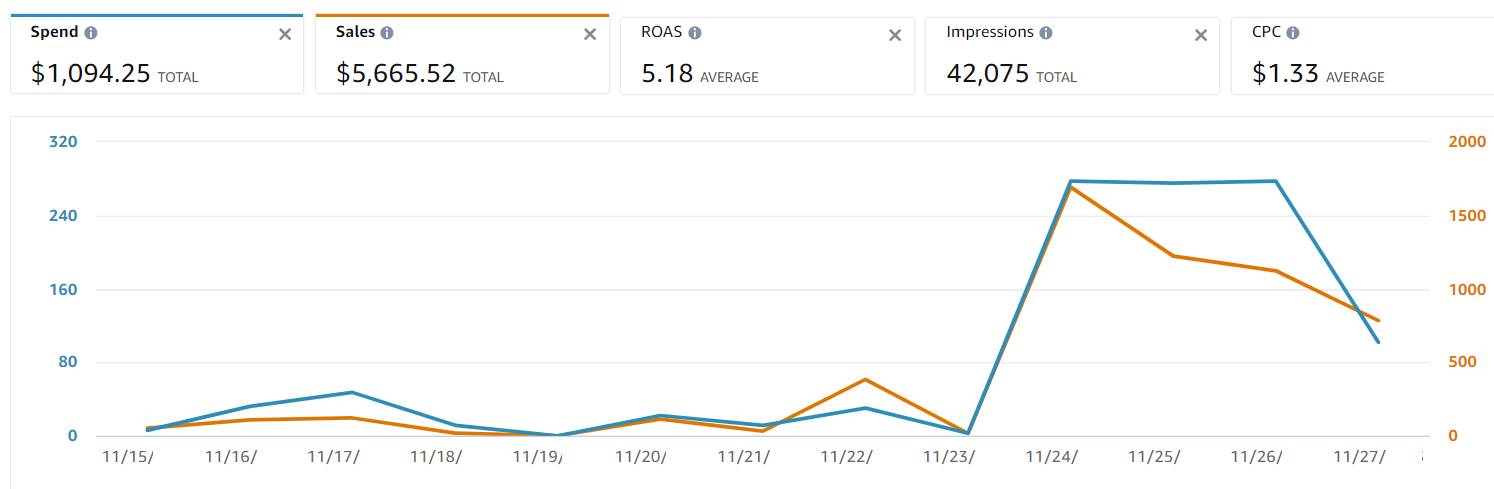

From November 19th we started to invest more in advertising to boost products’ visibility. We reached a peak in sales of $32,202 on November 24th for Black Friday.

Black Friday / Cyber Monday Sales $5,628.26

Black Friday Sales $75,140.30 / without Cyber Monday

ADVERTISING

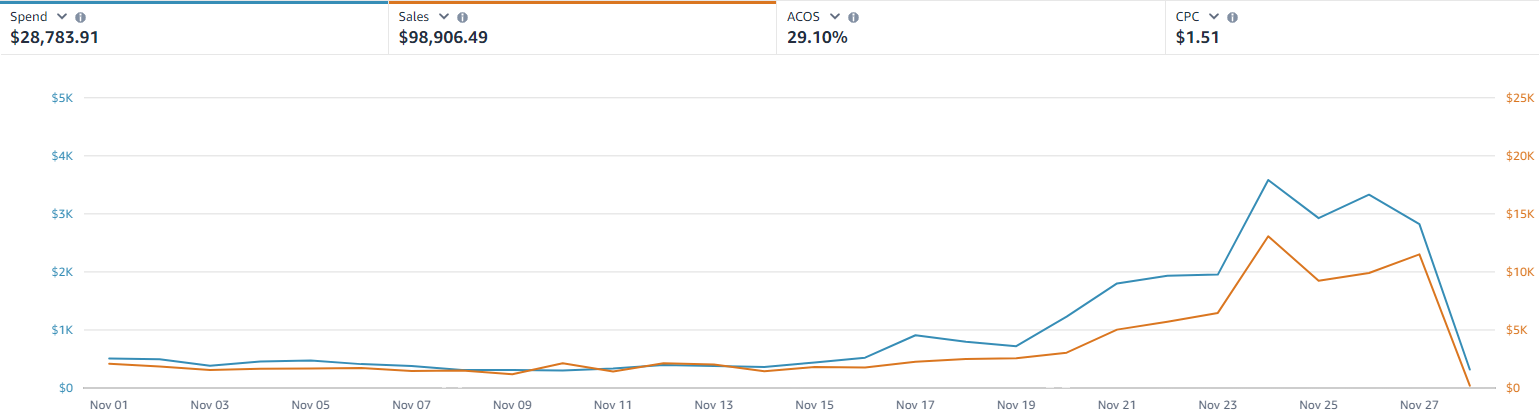

MTD (November 27th)

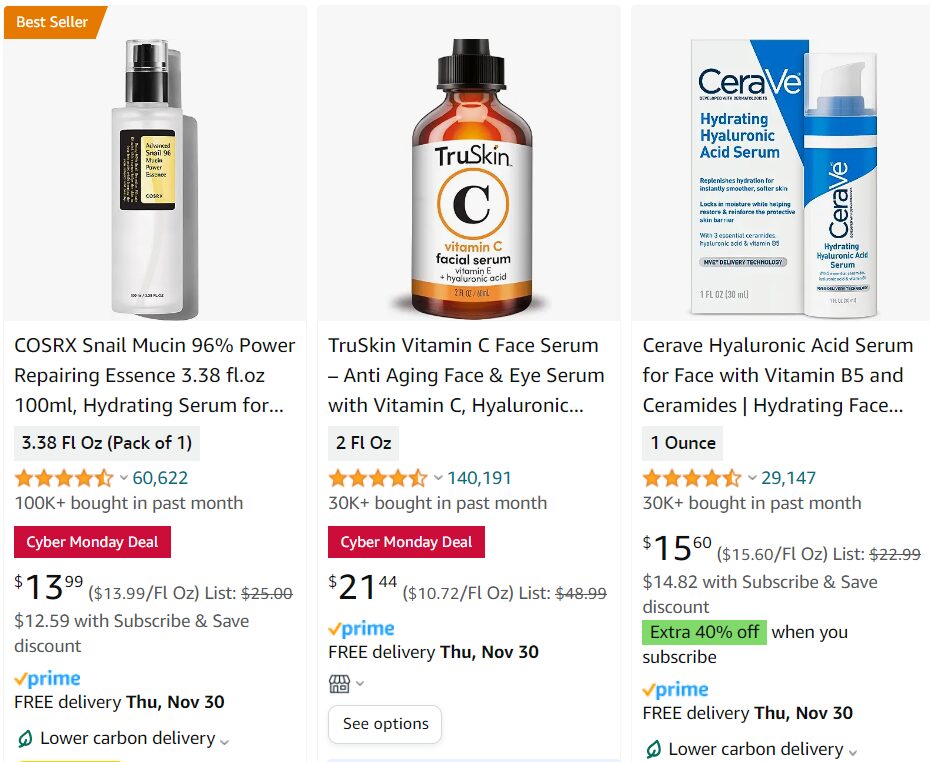

One product in particular was our best seller for the subcategory of “facial serums” which is a very competitive niche with dominant brands such as CERAVE, TruSkin, and COSRX:

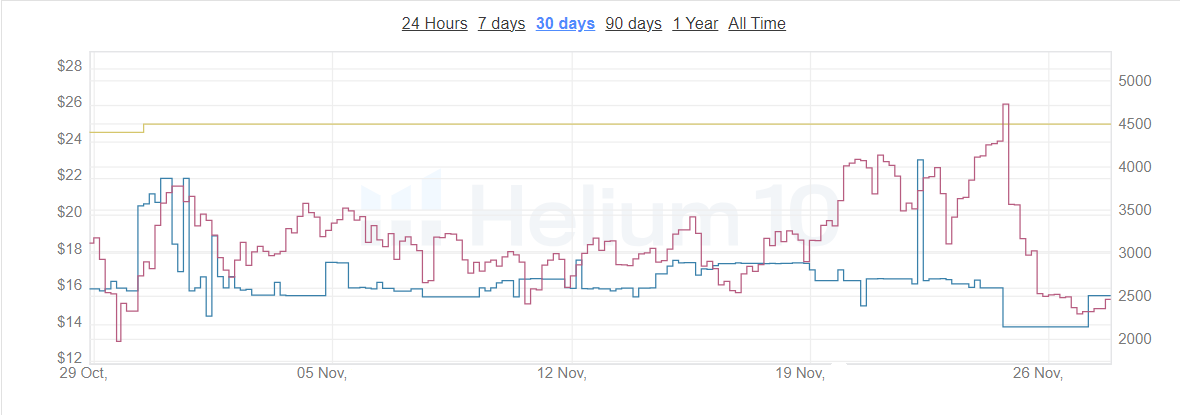

We targeted the Sponsored Products and Brands campaign with branded keywords, reaching $17,229.65 in sales and a Sales Rank below 2,500.

In the following graph taken from Trendster (Helium10), we can see that the product's sales rank improved significantly during Black Friday, reaching a sales rank below 2,500. Also, after the end of the deal on November 27th the rank has remained stable, close to 2,500, vs. an average sales rank of 3,500 before the event:

The following is the snapshot of the Sponsored Products Campaign for this product. We can see a peak from Nov. 23 when we started to increase our investment, seeking for more visibility for the BFCM event:

CONCLUSION

In order to be successful when participating in large retail events such as Black Friday and Cyber Monday, it is essential for brands to have a comprehensive plan to make the most out of their sales and brand recognition. It is essential to stay up to date with the current trends for the year and the previous year, be prepared with inventory, and employ various advertising initiatives to increase sales.

The holiday season can be competitive for sellers, especially for categories such as beauty and personal care where there are established brands that own a great part of the market share.

Nevertheless, it offers a great chance to maximize revenues and amplify brand awareness with the right strategic approach.

If you have additional questions or want us to help you on your Amazon journey, don’t hesitate to contact the BellaVix Team.

Keep Up with Amazon and Walmart Seller News

One place where we can find all of the most updated information on everything Amazon and Walmart.

Sign up for our newsletter to keep up with the news and updates in the industry.

Need competitive insights or to catch the pulse on the market?

Submit an inquiry to connect with the BellaVix team today!