The Federal Trade Commission (FTC) is reportedly preparing a lawsuit against eCommerce titan Amazon, which could result in significant operational changes or even a company breakup. The anticipated lawsuit seems likely to examine several aspects of Amazon’s business practices, with potentially momentous ramifications for Amazon sellers and the broader eCommerce industry.

1. The Allegations: An Overview

According to inside sources, the FTC has been drafting a complaint against Amazon since the end of last year. FTC Chair Lina Khan has had Amazon in her crosshair since 2017 when she published her argument in The Yale Law Journal, Amazon’s Antitrust Paradox. To summarize the allegations in her paper, assessing Amazon’s market power solely by price and output doesn’t fully capture the risks it poses to competition. Policymakers, she asserted, need to consider the possibility of Amazon undercutting prices to eliminate rivals, and the impact of its various businesses merging which could harm competition.

Here are several areas of Amazon’s business practices that the lawsuit is likely to focus on:

1.1 Amazon Prime

Amazon Prime, a subscription service offering unlimited free shipping among other perks, has evolved to include books, music, and video streaming. The FTC’s concern with Prime lies in the belief that the bundle of services is being used to unfairly solidify the company’s market dominance. It fails to acknowledge that other marketplaces like Walmart + have free same day delivery, Paramount+ streaming, fuel discounts and travel perks. You can also see similar behavior with Costco, Google Workspace, Netflix, and Cable TV. Bundling of services is nothing new and in fact increases competition and does nothing but benefit consumers by providing more value in a single purchase.

1.2 Amazon’s Price Parity Provisions

The complaint is also expected to challenge Amazon’s price parity encouragement, which informs marketplace sellers when their products are being sold at lower prices in other webstores. According to the FTC, these rules require third-party retailers to offer their lowest prices on Amazon’s platform, thereby eliminating the possibility of lower prices on competing websites. This is simply untrue.

Amazon does have a Fair Pricing Policy that requires sellers to treat customers fairly and not set deceptive or abusive prices. The Fair Pricing Policy is to protect customers from harm; it prohibits:

- Setting a reference price on a product or service that misleads customers;

- Setting a price on a product or service that is significantly higher than recent prices offered on or off Amazon;

- Selling multiple units of a product for more per unit than that of a single unit of the same product;

- Setting a shipping fee on a product that is excessive. Amazon considers current public carrier rates, reasonable handling charges, as well as buyer perception when determining whether a shipping price violates its fair pricing policy.

It is not stated in the policy, but failure to comply with the Fair Pricing Policy is a significant factor in how Amazon’s algorithm determines whether a seller’s product is presented as a “Featured Offer.” Featured offer status, formerly known as the Buy Box, allows for single-click purchases and is highly desirable for sellers because it is attractive to consumers. Fair Pricing failures can also result in listings suppression, account suspension, or termination of selling privileges.

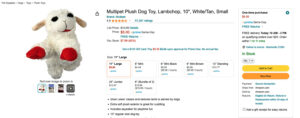

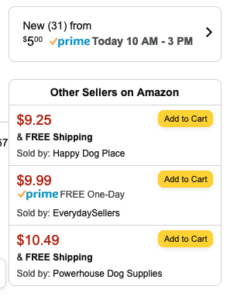

The Fair Pricing Policy clarifies that Marketplace sellers set their own prices, and there is no suggestion that sellers will lose selling privileges simply by not having the lowest price available. However, Amazon frequently highlights as Featured Offers the seller offering a product for the lowest price. You can see an example below.

Here, the Featured Offer is the lowest-priced product, but that is not always the case. For example, if the lowest price is from a seller who has too many returns, poor reviews, or misses shipping deadlines, that seller will not be featured.

1.3 Fulfillment By Amazon

The FTC is expected to claim that Amazon essentially requires sellers to use its logistics services – which include shipping and warehousing – by rewarding them with better placement on the site and penalizing them if they refuse.

Amazon does not require sellers to use FBA fulfillment in order to achieve better search ranking, receive the Featured Offer, or gain leverage on platform advertising. There are no penalties associated with using other fulfillment methods. Amazon rewards the Featured Offer to the seller that offers the best overall consumer service, including lowest price and fastest delivery, regardless of whether a seller utilizes FBA or Fulfilled by Merchant (FBM).

Recently Amazon announced that it will reopen Seller Fulfilled Prime, which will allow FBM sellers to have a Prime badge placed on listings as long as they meet delivery speed and accuracy requirements.

Sellers leveraging FBM services have the opportunity to sell as many products as FBA services. Certain product categories, particularly those that are small and inexpensive or large and bulky, traditionally benefit from FBM as FBA logistics and storage for those products can be costly.

1.4 Amazon’s Digital Advertising Practices

The rapidly growing digital advertising arm of Amazon will also likely be targeted. The FTC believes that the eCommerce giant is exerting undue pressure on merchants to purchase ads in order to get better placement in customer search results. As a rapidly growing arm of Amazon, the digital advertising sector is becoming an increasingly important revenue stream for the company. However, we fundamentally disagree with the FTC’s allegations and assert our position that Amazon operates within an open and fair market.

Advertising, by its very nature, is a competitive endeavor and is intended to gain improved placement. Merchants who choose to invest more in advertising do so with the understanding that this will enhance their visibility to customers – a basic tenet of business strategy. Furthermore, Amazon’s digital advertising platform is far from being the only avenue available for sellers to promote their products. There are myriad other channels and platforms, each with their own unique advantages and user demographics.

Amazon also offers sellers free features that allow sellers to occupy real estate in search results, on competitor pages, and in the inbox of Amazon Prime subscribers. Amazon Posts, Amazon Opportunities Explorer and Manage Your Customer Engagement are a few features that are free for Brand Registered sellers on the platform.

This is an example of a Manage My Customer Engagement email that can be sent out to all Amazon store subscribers and allows sellers to target shoppers in market, exposed to the brand or in aisle. This tool is free and will deliver the product message to inboxes of Amazon Prime subscribers.

2. The Potential Impact on Amazon Sellers

While the FTC’s intentions may be to protect small businesses and maintain fair competition, the lawsuit seems misguided, based on incorrect facts, and could have harmful unintended consequences for Amazon Sellers.

2.1 Disruption to Fulfillment by Amazon (FBA)

If the FTC’s lawsuit results in the end of FBA, many sellers will be hurt – badly. Amazon’s FBA program allows sellers to store their products in Amazon’s warehouses, from where Amazon takes care of storage, packaging, and shipping. This service is integral to many sellers’ business models, and its disruption could force them to seek alternative, potentially less efficient and more expensive, means of product fulfillment.

2.2 Changes to the Featured Offer

The lawsuit could also bring changes to Amazon’s Featured Offer – which recommends the seller offering the best combination of low price and high customer service for a particular product. The FTC’s concern is that sellers may be raising their product prices on other websites in order to maintain “fair prices” on Amazon and secure the Featured Offer position. Changes to the Featured Offer algorithm could alter the way sellers approach pricing, potentially leading to lower profit margins or the Featured Offer position defaulting to undeserving sellers.

3. What it Means for Consumers

Consumers also stand to be harmed by the FTC’s lawsuit against Amazon.

3.1 Potential Disruption to Amazon Prime

Amazon Prime’s bundle of services, including unlimited free shipping, music, and video streaming, is extraordinarily popular because it provides immense value for consumers. If the FTC’s lawsuit results in the breakup of this bundle, consumers may be forced to pay more for each individual service.

3.2 Changes to Pricing

The FTC’s concerns about Amazon’s pricing policies could lead to changes that impact consumers. If changes to this feature are enforced, consumers may have to spend more time comparing prices and reading reviews and could end up paying more for their purchases.

4. Impact on eCommerce and Other Industries

The potential implications of the FTC’s lawsuit extend beyond Amazon and its sellers. The lawsuit’s outcome could set a precedent for how large tech companies are regulated, with wide-reaching implications for the eCommerce industry and beyond.

4.1 Increased Government Oversight

If the FTC’s lawsuit against Amazon is successful, it could signal a new era of increased government oversight in the tech sector. This could lead to further investigations and lawsuits against other large tech companies, potentially disrupting the industry and stifling innovation.

4.2 Changes to Business Practices

The lawsuit could also force changes to business practices across the eCommerce industry. Other eCommerce platforms may need to reassess their pricing policies, fulfillment services, and advertising practices to ensure compliance with any new regulations or precedents set by the lawsuit.

5. The Bigger Picture: A Fight for Fair Competition or Government Overreach?

While the FTC’s intentions to protect small businesses and maintain fair competition are commendable, there are concerns that the lawsuit could amount to government overreach. The potential disruption to Amazon’s services and the wider eCommerce industry could harm the very businesses the FTC aims to protect. Just watch any episode of Shark Tank. The question, where are you currently selling, “our website and Amazon” is the most common answer because Marketplace offers unbeatable and low-cost accessibility for brand owners to establish a presence and validate products in the marketplace.

It’s important to note that while Amazon is a dominant player in the eCommerce industry, it isn’t the only player. Other large retailers like Walmart and Target offer their own competing services. Breaking up Amazon’s bundle of services could result in consumers having to pay more for each individual service, which hardly seems beneficial.

Furthermore, the FTC’s concern with Fulfillment by Amazon seems misguided. Amazon’s FBA program is a valuable service for many sellers, offering efficient and reliable product fulfillment. The disruption of this service could harm sellers’ businesses and lead to a poorer customer experience.

FTC Chair Lina Khan’s paper is somewhat misguided as it does not justify reforming antitrust. Regulators can use existing analytical methods to distinguish anticompetitive conduct from pro-competitive conduct. We don’t need new laws to accomplish this.

In conclusion, while the FTC’s intentions may be to protect competition and small businesses, the potential consequences of this lawsuit could be far-reaching and harmful to sellers, consumers, and the broader eCommerce industry. It’s essential to consider the broader implications before charging ahead with such drastic action.

Additional Sources:

- https://www.politico.com/news/2023/07/25/ftc-lawsuit-break-up-amazon-00108130

- https://www.wsj.com/articles/amazon-to-meet-with-ftc-officials-ahead-of-expected-antitrust-complaint-fbb0927f

- https://medium.com/chamber-of-progress/bidenomics-is-working-for-consumers-so-why-is-the-administration-suing-to-break-up-amazon-prime-ee44a3de62f3

- https://itif.org/publications/2023/03/01/flawed-analysis-underlying-calls-for-antitrust-reform-revisiting-lina-khans-amazons-antitrust-paradox/